BTC Price Prediction: $150K Target as Institutional Adoption Meets Technical Breakout

#BTC

- Technical Setup: Price above key MAs with Bollinger Band squeeze suggesting volatility expansion

- Institutional Catalyst: Metaplanet's 18,113 BTC treasury and Norway fund's increased exposure

- Macro Tailwinds: Controlled inflation (CPI 2.9%) reduces rate hike risks

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Building

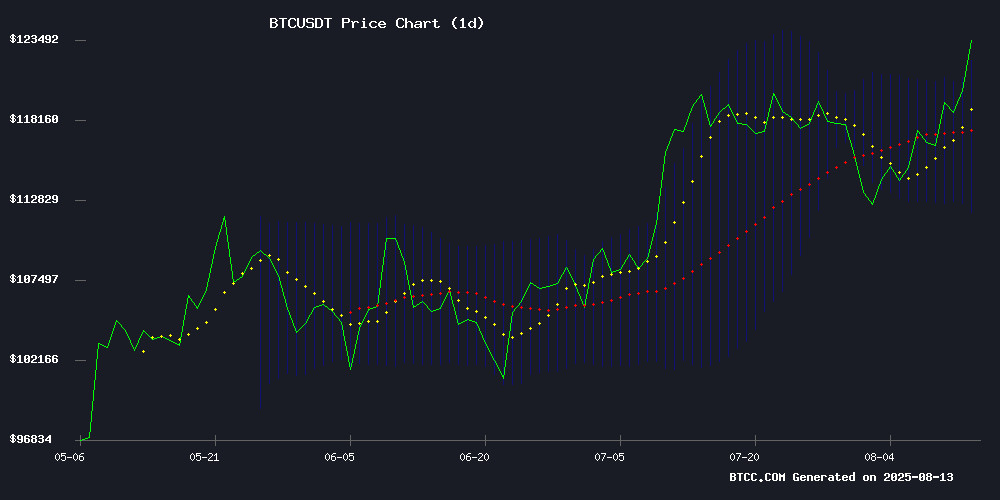

BTC is currently trading at, above its 20-day moving average of 116,903.06, signaling bullish momentum. The MACD histogram shows a slight bearish crossover (-218.69), but price remains NEAR the upper Bollinger Band (121,366.28), suggesting continued upside potential.says BTCC analyst Mia.

Institutional Adoption Fuels Bitcoin Optimism

Metaplanet's 18,113 BTC holdings and new Bitcoin-backed products highlight growing institutional demand. Norway's sovereign wealth fund increasing exposure adds to positive sentiment.notes BTCC's Mia.July's tame CPI data (2.9%) creates favorable macro conditions for risk assets.

Factors Influencing BTC’s Price

Metaplanet's Q2 Surge Fueled by Bitcoin Holdings and Financial Turnaround

Metaplanet Inc. (3350.T) has emerged as Japan's leading crypto-centric firm following a remarkable second-quarter performance. The company's stock closed at 993.00 JPY, up 1.85%, after breaching key resistance levels during late trading. This rally coincides with the revelation that Metaplanet now holds 18,000 BTC ($1.85 billion), ranking sixth globally among corporate Bitcoin treasuries.

The financial turnaround is stark: ¥17.4 billion ($117.8 million) in ordinary profit reverses last year's ¥6.9 billion loss. Net assets skyrocketed 299% quarter-over-quarter to ¥201.0 billion ($1.36 billion), while revenue grew 41% to ¥1.239 billion ($8.4 million). These metrics underscore how Bitcoin adoption is reshaping traditional corporate finance in Japan.

Metaplanet's strategic pivot to cryptocurrency mirrors MicroStrategy's playbook, but with distinct advantages in Asia's evolving regulatory landscape. The firm's 333% quarter-on-quarter asset growth to ¥238.2 billion ($1.61 billion) demonstrates how Bitcoin holdings can turbocharge balance sheets during crypto market upswings.

Metaplanet's Bitcoin-Backed Surge: A Q2 Turnaround Story

Metaplanet Inc. (3350.T) has emerged as Japan's unlikely crypto champion, with its stock climbing 1.85% to 993.00 JPY following a remarkable second-quarter performance. The company's 18,000 BTC treasury—now valued at $1.85 billion—propelled a 299% quarter-on-quarter surge in net assets, dwarfing traditional financial metrics.

The Tokyo-listed firm reported ¥17.4 billion ($117.8 million) in ordinary profit, reversing a ¥6.9 billion loss from the prior period. This Bitcoin-powered renaissance saw net income swing to ¥11.1 billion ($75.1 million) against a previous ¥5.0 billion deficit. Metaplanet's crypto reserves now rank sixth globally among corporate holders—a strategic bet that's rewriting Japan's institutional adoption narrative.

Metaplanet Unveils Bitcoin-Backed Financial Products Amid Strong Q2 Results

Tokyo-based Metaplanet (3350) is making strategic moves to solidify Bitcoin's role in Japan's capital markets. The investment firm reported a dramatic turnaround in Q2, swinging from a 5.0 billion yen loss to an 11.1 billion yen profit, with revenue jumping 41% quarterly to 1.239 billion yen.

The company announced two Bitcoin-centric initiatives: 'Metaplanet Prefs' perpetual preferred shares and plans for a BTC-backed yield curve. These instruments aim to establish Bitcoin as collateral in Japan's fixed income market, mirroring MicroStrategy's approach while catering to domestic demand.

As Japan's largest public Bitcoin holder, Metaplanet intends to set new standards for BTC-backed credit products. The yield curve framework would enable institutional pricing of Bitcoin-collateralized instruments, expanding exposure opportunities.

Metaplanet Tops Asian Bitcoin Holdings with 18,113 BTC

Metaplanet has emerged as Asia's leading corporate Bitcoin holder, amassing 18,113 BTC according to its Q2 2025 report. The Tokyo-based firm now ranks fourth globally in BTC treasury holdings, bolstered by a 242.2 billion JPY capital raise dedicated to cryptocurrency acquisitions.

The company's Bitcoin strategy yielded extraordinary returns, posting a 468.1% yield on its cryptocurrency investments. This performance cements Metaplanet's position at the forefront of corporate Bitcoin adoption in the region, reflecting growing institutional confidence in digital assets as long-term value stores.

NexChain vs. Bitcoin Swift: Investors Weigh Presale Strategies Amid Market Momentum

NexChain's prolonged presale period is drawing scrutiny as investors increasingly favor projects with quicker returns. While the extended timeline may build a broader holder base, it delays utility realization—a growing concern in a market where speed-to-reward matters.

Bitcoin Swift (BTC3) emerges as the antithesis, leveraging a hybrid Proof-of-Work/Proof-of-Stake architecture with programmable yield mechanics. Its AI-driven reward engine and compliance-ready framework resonate with current demand for turnkey profit solutions.

Bitcoin's Evolution: From Speculative Asset to Mainstream Contender

Once dismissed as a speculative fantasy during Bitcoin's 2017 bull run, institutional adoption has become reality. El Salvador's landmark legal tender adoption and U.S. legislative movements signal a tectonic shift in cryptocurrency legitimacy. PrimeXBT now provides traders with sophisticated instruments like Crypto Futures and CFDs to navigate this transformed landscape.

The critical question emerges: Is Bitcoin transitioning from volatile digital gold to a stabilized traditional asset class? Metrics suggest growing parity with gold's market behavior, particularly as nation-states explore strategic reserves. This maturation mirrors early predictions from the 2017 cycle that seemed improbable at the time.

Bitcoin Will Dominate as All Assets Lose Value, Warns Samson Mow

Samson Mow, CEO of JAN3 and a staunch Bitcoin advocate, asserts that all assets are trending toward zero when measured against Bitcoin. His tweet—"Everything is trending to zero against #Bitcoin. Don't ever forget that"—underscores his maximalist stance. Bitcoin's fixed supply of 21 million coins, with over 19 million already mined, creates unparalleled scarcity. Unlike gold, stocks, or fiat, Bitcoin cannot be diluted, printed, or endlessly produced.

Mow's $1 million price target for Bitcoin hinges on its adoption curve and role as a benchmark asset. The logic is simple: as Bitcoin's network effect grows, other assets depreciate in relative terms. El Salvador's 2021 decision to adopt Bitcoin as legal tender lends credence to this thesis. Max Keiser and other maximalists echo Mow's conviction, framing Bitcoin as the ultimate store of value in an era of monetary debasement.

Crypto Markets Rally as July CPI Data Signals Controlled Inflation

Cryptocurrency markets surged following the release of July's Consumer Price Index data, which showed inflation largely under control. The headline CPI rose 2.7% year-over-year, matching forecasts, while core CPI increased 3.1%—slightly above expectations. Bitcoin edged toward $119,000 as investors interpreted the figures as paving the way for potential Federal Reserve rate cuts.

Market expectations for a September rate cut jumped to 90%, fueling bullish sentiment across digital assets. The total crypto market capitalization reclaimed the $4.1 trillion threshold, with altcoins showing particular strength. While core inflation remains stubborn, the stable headline number removes a key barrier to monetary easing.

Traders appear to be pricing in a favorable liquidity environment, with risk assets benefiting from the diminished inflation threat. The Fed now faces a delicate balancing act—core prices continue to run hot even as broader measures show containment. This divergence creates both opportunities and volatility for crypto markets in the coming months.

Norway’s $1.9 Trillion Wealth Fund Boosts Bitcoin Exposure via Corporate Holdings

Norway’s sovereign wealth fund, the world’s largest at $1.9 trillion, has dramatically increased its indirect Bitcoin holdings. The fund now holds exposure equivalent to 7,161 BTC—a 192% surge from 2,446 BTC in Q2 2024. This strategic move comes entirely through equity stakes in Bitcoin-proximate corporations rather than direct cryptocurrency purchases.

Norges Bank Investment Management maintains its conservative approach by targeting companies with substantial Bitcoin reserves. Marathon Digital Holdings and Block Inc. anchor the position, with additional exposure through Tesla, GameStop, and Latin America’s Mercado Libre. The fund’s methodology reflects institutional caution toward direct crypto ownership while capitalizing on the asset class’s growth potential.

Vetle Lunde of K33 Research notes the allocation signals growing mainstream acceptance, albeit through traditional investment channels. Unlike pension funds diving into spot BTC ETFs, Norway’s vehicle prefers the regulatory clarity of publicly traded companies with crypto treasury strategies. The move coincides with Bitcoin’s maturation as a corporate reserve asset—a trend accelerated by MicroStrategy’s pioneering adoption.

How High Will BTC Price Go?

BTCC analyst Mia projects a 24.4% upside to $150,000 based on:

| Factor | Impact |

|---|---|

| Technical Breakout | 121,366 resistance → 150,000 target |

| Institutional Demand | Metaplanet/Norway fund flows |

| Macro Conditions | 2.9% CPI supports risk assets |

Key risk: MACD bearish divergence if price falls below 116,903 MA support.

150,000 USDT (+24.4%)

Q4 2025

High (Technical + Fundamental alignment)